Any Year End Tax Legislation Should Expand Child Tax Credit To Cut Child Poverty Center On Budget And Policy Priorities

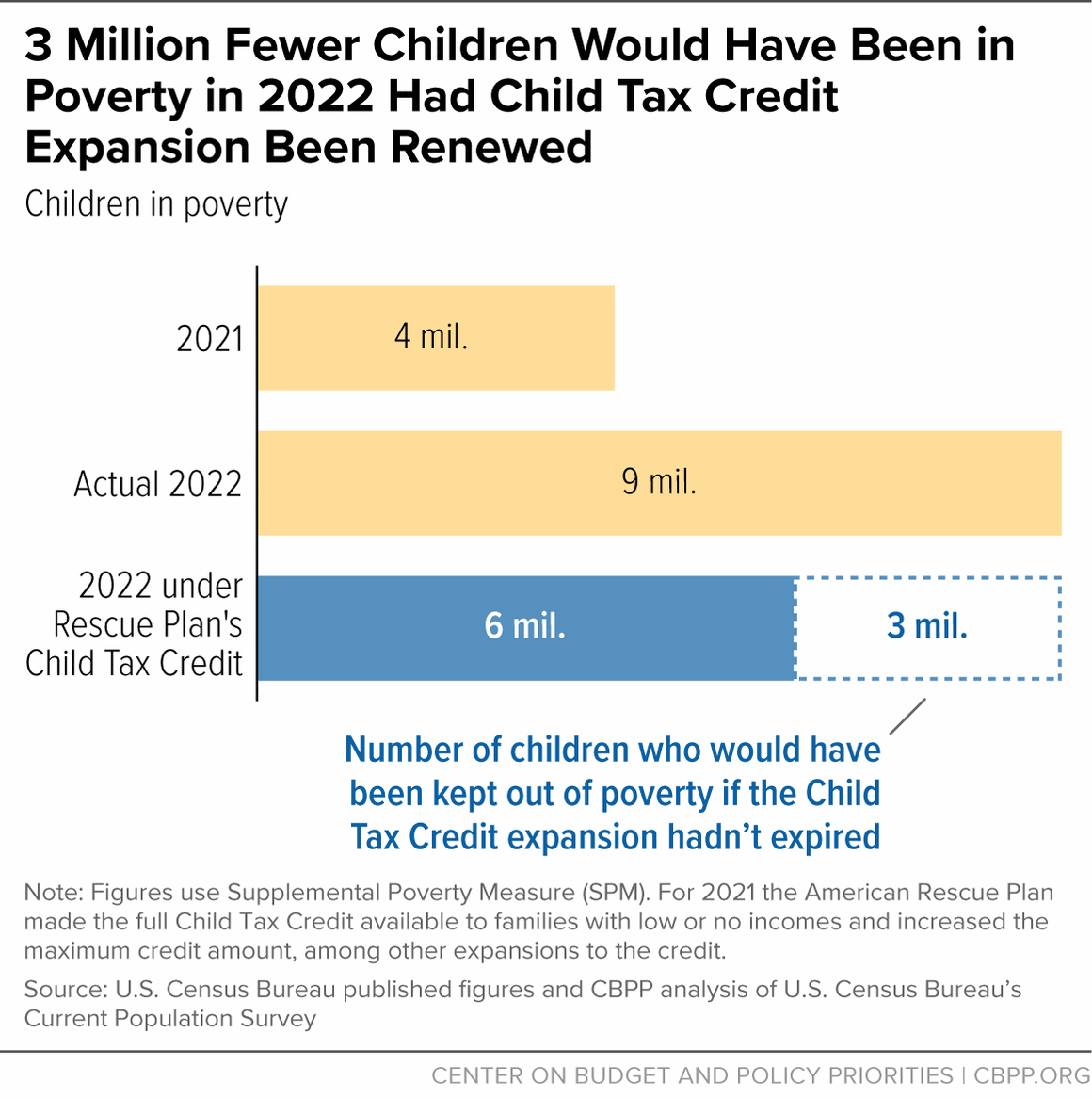

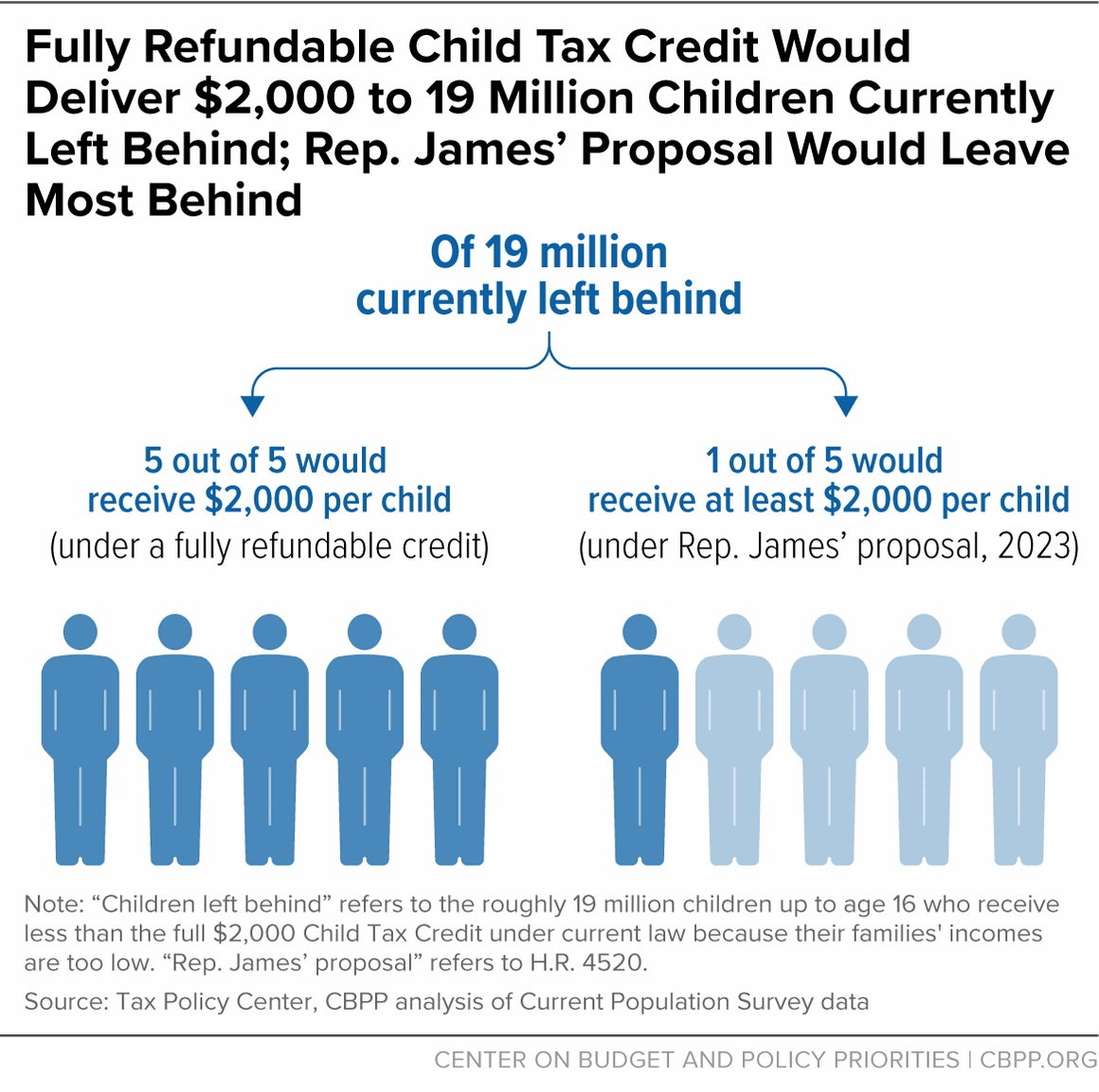

Despite its popularity the expanded tax credit expired in 2021 and in 2022 the benefit reverted to its earlier limit of 2000 per child That has had a dire impact on many low-income. According to the framework the maximum refundable portion of Child Tax Credit would increase from the current level of 1600 per child to 1800 in tax year 2023 1900 in tax year. Changes throughout 2021 such as a change in filing status change in the number of your qualifying children or a change in your income could increase or decrease the amount of. You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. For tax year 2022 the child tax credit is 2000 per child under 17 whos claimed on your tax return as a dependent Last year the credit was bumped up to 3000 per child 3600..

RC66SCH Status in Canada and Income Information for the Canada Child Benefits Application New residents returning residents and other immigrants use this schedule to give their world. Fill out this form to apply for the Canada child benefit and register your children for the goods and services taxharmonized sales tax GSTHST credit the climate action incentive. Fill out and sign Form RC66 Canada Child Benefits Application Include any additional documents needed for the situations described below Mail the form to your tax centre. Complete this form and send it along with any other required documents to one of our tax centres listed on page 2 of this information sheet. What is the RC66SCH form When you file your income tax you may use form RC66SCH to state your status in Canada if you are a new Canadian citizen became a resident in..

Ron Wyden D Ore and Rep Jason Smith R Mo said the plan includes a phased increase to the. Parents can claim up to 2000 in tax benefits through the CTC for each child under 17 years old. Comment Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the..

1M visitors in the past month..

Any Year End Tax Legislation Should Expand Child Tax Credit To Cut Child Poverty Center On Budget And Policy Priorities

Komentar